snohomish property tax rate

Though not uncommon for Snohomish County residents to approve levies and tax measures its that these increases have caught residents off guard due with their size and those residents have been voicing frustration across. Assessors Property Summary Search.

News Flash Snohomish County Wa Civicengage

Types of county reports include.

. For comparison the median home value in Snohomish County is 33860000. The Treasurers office will give a grace period for seniors and qualifying disability renewal applications for property tax exemptions. For a reasonable fee they will accept monthly payments and pay your tax bills when due.

If the tax due is more than 50 half of the amount due may be paid by April 30 and the balance by October 31. Snohomish County collects on average 089 of a propertys assessed fair market value as property tax. Explore important tax information of Snohomish.

For more information please visit the web pages of Snohomish Countys Assessor and Treasurer or look up this propertys current valuation and tax situation. Snohomish WA 98291-1589 Utility Payments PO. Learn all about Snohomish County real estate tax.

Do not put the House Number. 2022 taxes are available to view or pay online here. Visit Our Website Today.

In our oversight role we conduct reviews of county processes and procedures to ensure compliance with state statutes and regulations. Whether you are already a resident or just considering moving to Snohomish County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. If the amount of tax due is 50 or less full payment is due by April 30.

Accounts with delinquent taxes must first be approved by the Snohomish County Treasurers Office. Box 1589 Snohomish WA 98291-1589. Get Access To Snohomish Tax Records.

Snohomish County Treasurer Updates. The median property tax in Snohomish County Washington is 3009 per year for a home worth the median value of 338600. Please call 425-388-3606 if you would like to make payments on.

Payment of Property Taxes. Contact Evergreen Note Servicing online by clicking here or by phone at 253-848-5678. When summed up the property tax burden all owners shoulder is created.

In this mainly budgetary function county and local public leaders estimate annual spending. Snohomish County has one of the highest median property taxes in the United States and is ranked 155th of the 3143 counties in order of. And avoid using directionals.

Ad Make The Best Decision On Your First Home By Checking Tax Records Online. The Whatcom County average effective property tax rate is 085 compared to the Washington State average of 093. Please refer to the back of your tax statement to determine eligibility or you may contact the Snohomish County Assessors Office at 425-388-3540 for additional information.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. In the Street Name field. Levy Division Email the Levy Division 3000 Rockefeller Ave.

First half tax payments made after that date will need to include any interest or penalties. The first half 2022 property taxes were due April 30th 2022. The median property tax also known as real estate tax in Snohomish County is 300900 per year based on a median home value of 33860000 and a median effective property tax rate of 089 of property value.

Snohomish and every other in-county public taxing unit can now calculate needed tax rates since market value totals have been determined. MS 510 Everett WA 98201-4046 Ph. Individual Program Review of a single area of property.

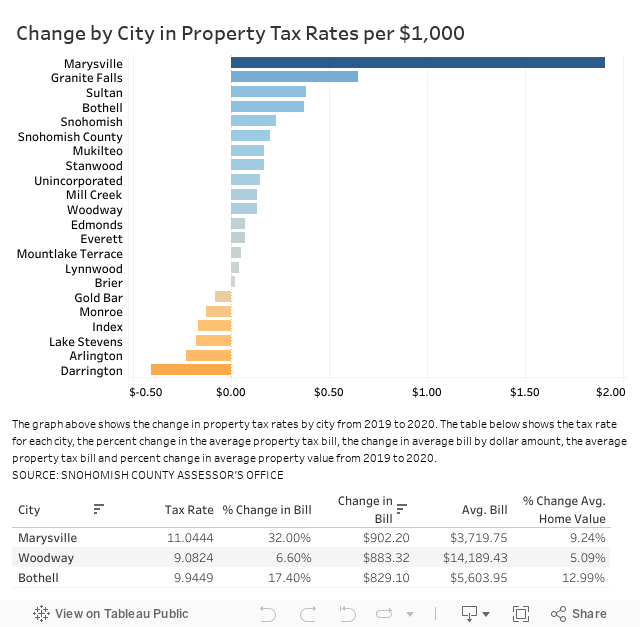

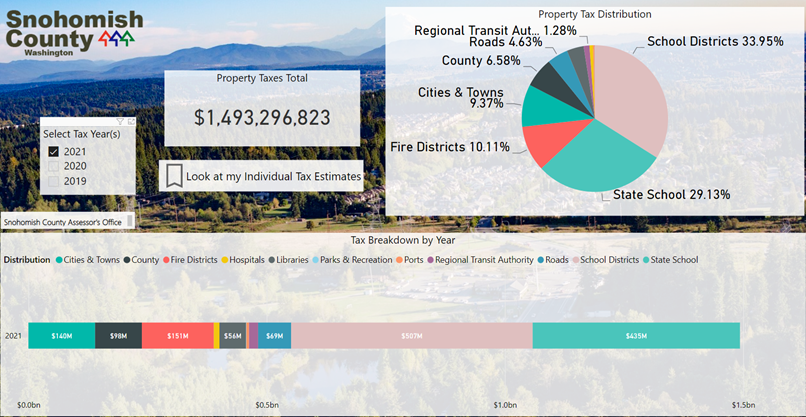

The median annual property tax in Snohomish County is 3615 second-highest in the state and more than 1000 above the national median. Property tax payments are due by April 30 and October 31. Property taxes have increased across Snohomish County due voter approved tax measures and school levies that will go in affect in 2020.

Our mailing address is. Snohomish WA 98291-1589 Utility Payments PO. The Department of Revenue oversees the administration of property taxes at state and local levels.

Box 1589 Snohomish WA 98291-1589 Report a Problem after-hours 360 563-2012 Non-police related. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Snohomish County. Snohomish County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

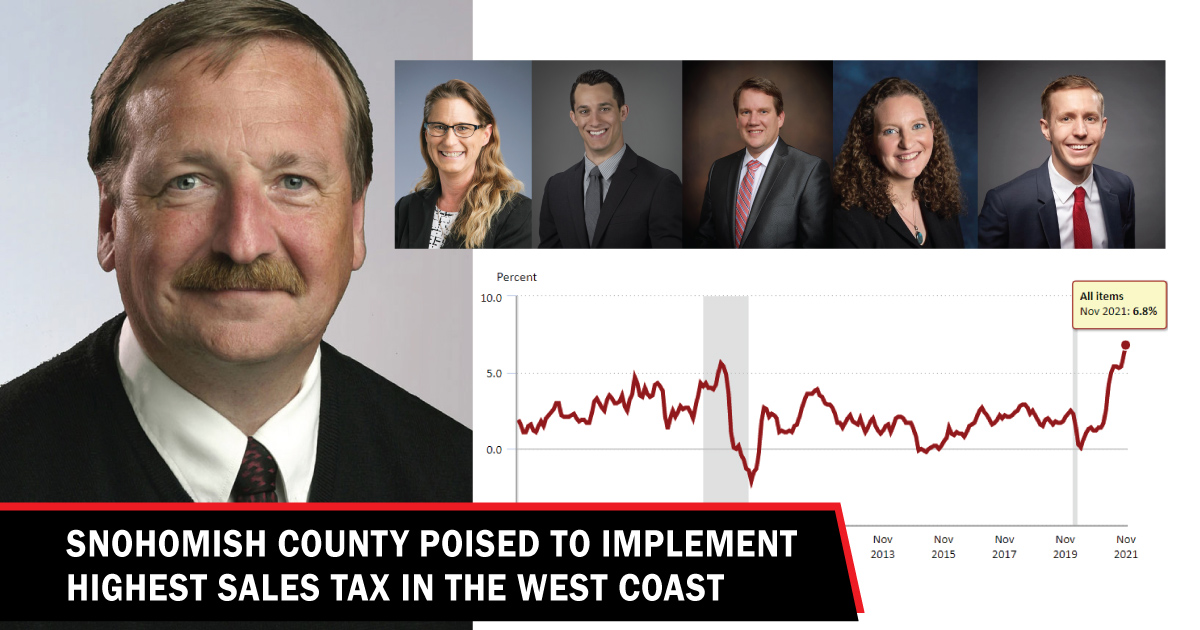

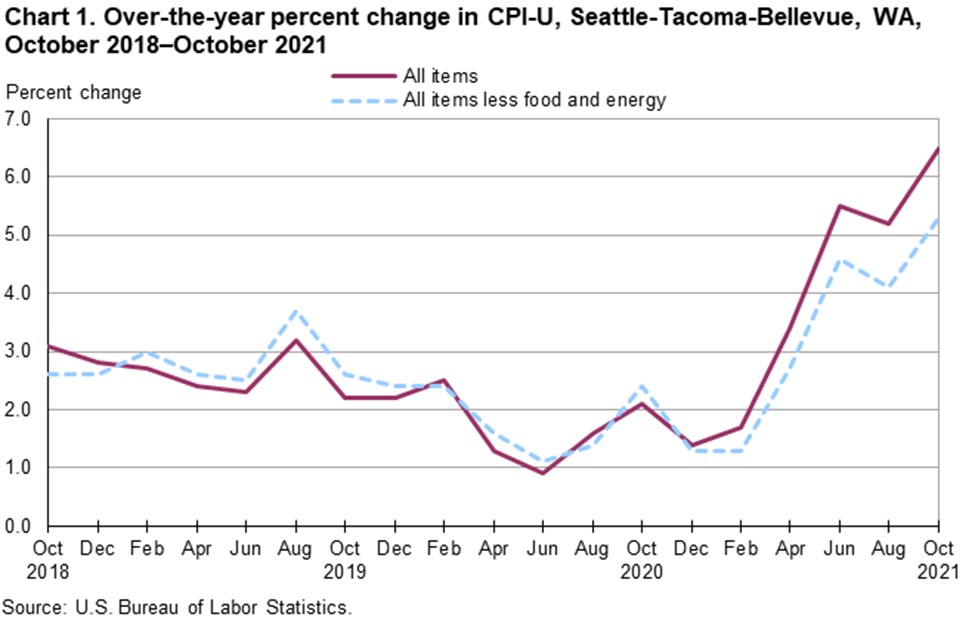

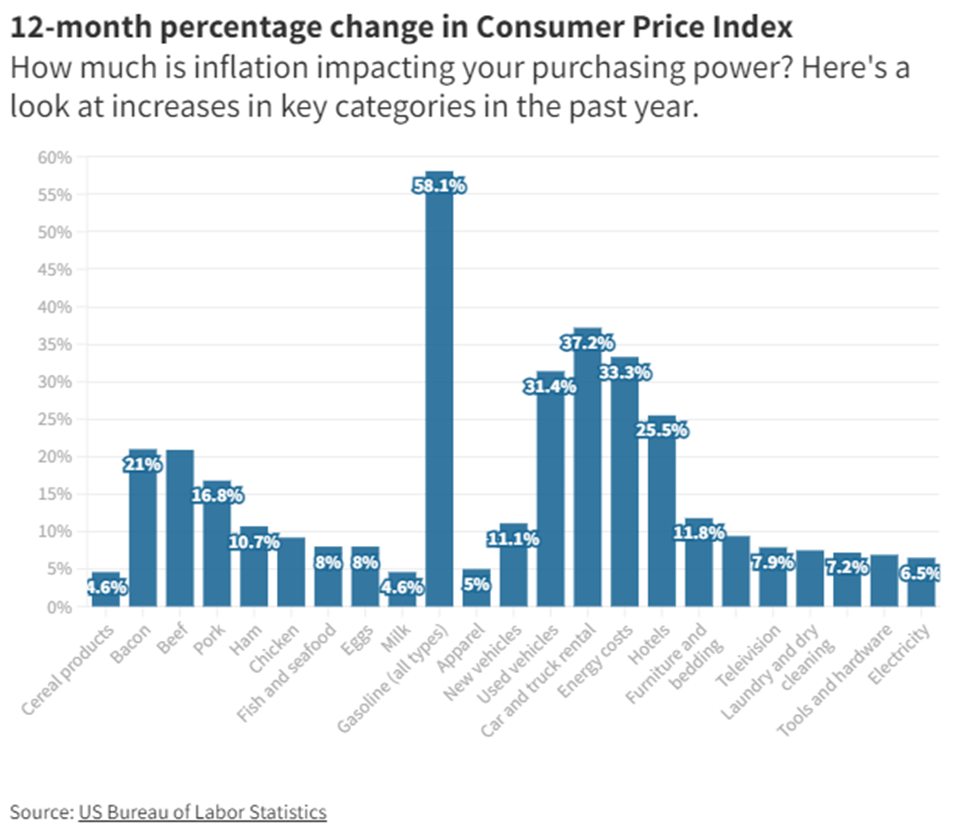

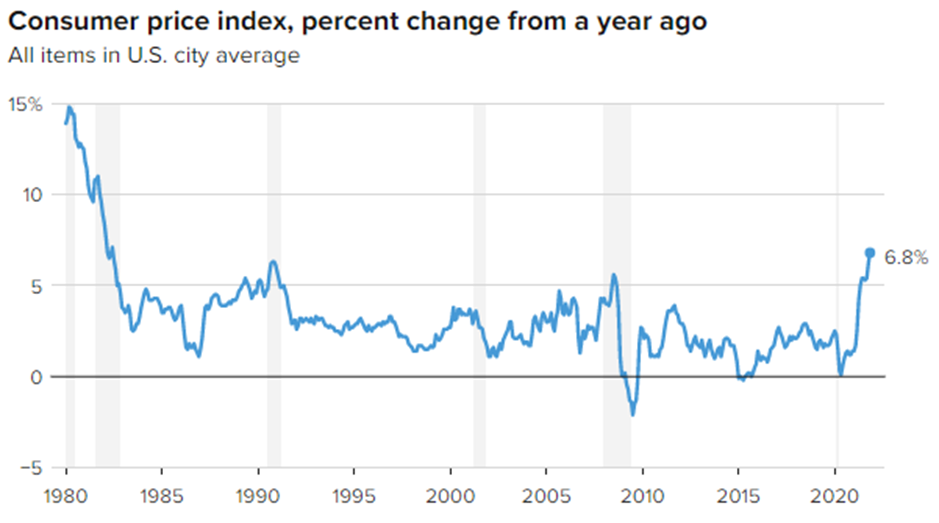

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Pros And Cons Of The Wheda Loan

Property Taxes Rise For Most Of Snohomish County In 2020 Heraldnet Com

Graduated Real Estate Tax Reet For Snohomish County

Snohomish County Property Values Increasing Rapidly King5 Com

How To Read Your Property Tax Statement Snohomish County Wa Official Website

How To Calculate Property Tax In Snohomish County Washington Destinationpackwood Com

What Snohomish County Would Pay And What St3 Would Deliver Heraldnet Com

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

Property Taxes And Assessments Snohomish County Wa Official Website

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times

County Poised To Pass 0 1 Sales Tax As Inflation Hits 40 Year High Lynnwood Times